This post is the continuation of a discussion started on Marketing Profs’ LinkedIn group on July 7th. (If you don’t yet subscribe to the group, consider becoming a part of it.)

Today’s video is actually two videos in one:

The first half (Part 6 of our Social Media ROI series) deals with defining ROI once and for all.

The second half (Part 7 of our Social Media ROI series) starts touching on the “how” of calculating the ROI of Social Media by outlining the investment-action-reaction-impact-return narrative.

If the video doesn’t load for you, you can go watch it here.

Let me start today’s post with a confession: Like many people in the business world, I have abused the term “ROI” from time to time. Yes, I admit it, even I have used “ROI” as a relative term on a number of occasions in the past. I’m not proud of it, but there it is.

Here are some examples of what I am talking about:

- Q: What’s the ROI of adding 100 miles to my weekly cycling training?

- A: Faster race times.

- Q: What’s the ROI of writing better blog posts?

- A: More traffic on my blog.

It’s easy to do, especially since sometimes, what you invest into something isn’t necessarily $$$. Perhaps you invested sweat. Perhaps you invested time. Perhaps you invested emotions. It doesn’t really matter. The point is that when the currency is variable, how you measure the “I” in ROI becomes variable as well. For lack of a better term, you start to refer to any kind of positive outcome as “ROI” even when you shouldn’t. It’s an easy habit to fall into, and if you aren’t careful, your definition of ROI can begin to get a little fuzzy. So I get it: I understand why this is confusing to so many folks, especially when it gets thrown into the world of Social Media.

But I’ve also spent enough time with executives (on the client side) to know that when THEY talk about ROI, the currency is NOT relative. In business terms, the currency implied in any ROI question or discussion is cold hard cash. Period.

Marketing professionals need to understand this: If the investment (the “I”) is $$$, then the return also has to be $$$. It can’t be eyeballs or impressions or clickthroughs. You have to tie your results to a $ amount. Anything short of that, and you’re not proving your value to your boss or client.

It isn’t to say that eyeballs, impressions and clickthroughs aren’t important. They are. But they’re one link (of the action-reaction-outcome narrative) shy of ROI. (They don’t tie the investment to the actual return.)

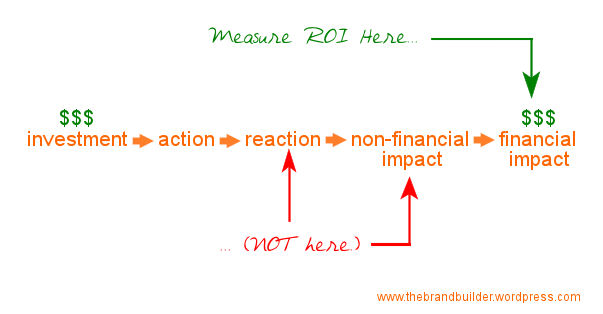

The best way to explain that narrative is this way:

$ Investment by company –> Action –> Reaction –> Non-financial impact –> Financial impact $

As explained above in the video, the relationship between a company’s investment and the return on that investment pretty much looks like this:

What happens between the investment and the financial impact (the return on that investment) is VERY important. And we’ll talk about the importance of monitoring and measuring it in order to tie the investment to the associated financial impact (and ROI) in future posts. But for now, I want to focus on the fact that eyeballs, impressions, positive WOM and social mention, even click-throughs and net new visits to websites do not constitute relevant currency when we are talking about ROI. Social media is no different here than any other business endeavor in this regard.

Impressions, eyeballs, net new visitors, etc. are forms of non-financial impact. In order to determine ROI, you have to take them to the next step: How they affect financial impact. THEN and only then can you tie the original investment to the return (financial impact/outcome).

I know that bringing “media” measurement into the ROI equation is tempting , especially for folks with agency or media measurement backgrounds. That’s what the model has been for PR, Advertising and other marketing-specific firms for decades. And again media measurement is vital here, but when it comes to calculating ROI, that type of measurement is a lot like calculating a crop’s yield by estimating how many of X number of planted seeds will germinate come harvest time. It doesn’t work that way. You have to roll up your sleeves come harvest time *and physically count what the actual yield is. You actually have to do the work. ROI isn’t about potential. It’s about actual performance.

I know that bringing “media” measurement into the ROI equation is tempting , especially for folks with agency or media measurement backgrounds. That’s what the model has been for PR, Advertising and other marketing-specific firms for decades. And again media measurement is vital here, but when it comes to calculating ROI, that type of measurement is a lot like calculating a crop’s yield by estimating how many of X number of planted seeds will germinate come harvest time. It doesn’t work that way. You have to roll up your sleeves come harvest time *and physically count what the actual yield is. You actually have to do the work. ROI isn’t about potential. It’s about actual performance.

(*Luckily there is no seasonal constraint like a “harvest” in the business world, so ROI measurement – like most performance measurement – can be continuous.)

In order to adequately determine ROI, you must first understand how all the pieces fit. You have to see the entire equation, from start to finish. There is an order to how things happen, how, and why. You have to see how A leads to B leads to C in order to understand how an investment turns into a success or a failure, and to what degree. You also have to understand that the value of a pair of eyeballs, of an impression, is subjective until that pair of eyeballs actually does something. Then the body attached to that pair of eyeballs becomes one of three things: A browser, an influencer or a transacting customer. The first two don’t actualize a financial impact (yet). The third does. That’s where we want to focus when dealing with ROI.

Though we can infer and assign an estimated $ value to browsers and influencers, these values are subjective at best , usually measured in hindsight, and subject to change at any moment for any reason. So their value still falls into the category of non-actualized potential for now. (We will look at the financial impact of influencers in an upcoming post. No worries.) For the purpose of ROI calculation, however, you want to work with cold hard numbers. Not estimates, not potential, not yet-to-happen transactions, but “actualized dollars.” Real revenue from actual sales. Financial returns you can take to the bank and tie step by step through the above chain back to the initial investment.

(Incidentally, financial impact (ROI) manifests itself either as increased revenue or cost savings. Sometimes, ROI is revenue-neutral but cut costs internally. The model I just described above applies ti revenue-generated ROI.)

All of this to say that we have to be VERY careful not to a) mistake non-financial impact with ROI, and b) not to try and redefine “ROI” when dealing with business execs. (They won’t buy into “Return on Influence” or “Return on Interest” for very long, and anyone using these terms runs the risk of losing credibility with pragmatic decision makers in the C-suite.) Social Media is fun, but this is not a game. If a client doesn’t ask about ROI, great! Awesome. They probably get how Social Media is going to help them build relationships with customers and improve everything about their business. So to them, ROI is implied. It’s understood. It isn’t something they are going to worry about anytime soon. But when a client DOES ask about ROI, you have to a) understand what they are asking, and b) know how to adequately answer their questions and put measurement systems in place that will suit their needs and particular culture.

I hope this was helpful. Next, we’ll talk about the importance of timelines in the ROI determination process. (The next piece of the puzzle.)

By the way, if the video didn’t load properly for you or if you are accessing this post from a mobile device, you can go watch the video here (thanks Viddler).

Fuzzy Math – is that long division? 🙂

Your videos are top drawer Olivier, you have a way of articulating the definition of ROI in a very disarming delivery. If I was sitting in front of you as a client I would feel safe because of your style and would do business with you because of your understanding of Marketing and it’s indicators.

I’m wondering if you shouldn’t package your video’s as a product / service to sell to up and coming marketers, you could participate in making the Social Media Marketing world a safe and better place plus give it the right kind of credibility.

Keep up the good work.

Owen

Owen, I am so using this comment for promotional purposes, you have no idea! 😀

I’m honored, feel free to use me as a reference..I’m in your camp.

Yet another excellent post reinforcing the actual, real-world concept of ROI.

For most of the companies that I’ve dealt with to implement a SM strategy, their inability to measure actual, transactional ROI is due to their lack of reliable internal systems that tie a specific transaction to SM activity.

Many “know” that their SM activities have generated sales, but they have no reliable method to tie SM participation to a single transaction.

Those companies who use SM enabled CRM systems, like salesforce.com, have these kind of tracking tools available, but others have to perform the drudgery of designing and implementing a tracking system for their salesforce to use. Not as exciting as designing and executing the SM strategy, but just as crucial or they’ll never have real data that can justify or negate their SM strategy.

I can’t wait for Part 8 in 3-D.

You are SO dead-on.

SM-ready CRM / Social CRM and SM-friendly monitoring tools are absolutely crucial to make that middle-part work. I can’t imagine trying to make it all work without them. I don’t think you could.

In order to adequately monitor and measure the non-financial impact of SM, you need a solid suite of monitoring tools. There is no way to do this well without those tools. So… if a business invests in a social media practice, it also has to understand that if it wants to measure ROI and have the ability to see what works, what doesn’t work (and make tactical changes in direction), it needs to also invest in the right “dashboard.”

By the way, have you seen how seamlessly Radian6 and Salesforce.com integrate now?

Thank you for sharing this information Oliver. I learn so much from your posts. I must admit I was one of those lumping subjective data into the ROI equation. No more… Your explanations make perfect sense even to someone as mathematically-challenged as me. Thank you for putting ROI in perspective for me.

I do have a question though. ROI in my business is boat sales and a boat sale, like most sales, can be caused by a number of factors. Dealer interaction, traditional WOM, traditional marketing, social media, etc. In fact in many cases I believe boat buyers are touched and influenced by all of these marketing and PR mediums before the sale is made. How can we determine the percentage of influence just one of these mediums has on the sale? I’m not sure how to show the “Powers that Be” how much our social media efforts are realistically affecting boat sales. If you have any insight on this, I would really appreciate it.

Thank you. Keep posting! Love your stuff.

Amy

Hi Amy. Thanks for the comment and question. I am going to get into that next week but for now, think about this:

What you want to look at initially are deltas. Changes in performance. So in the old MBA adage of “all things remaining the same,” (same advertising spend, same trade shows, same marketing, same business development, and same results quarter after quarter, year after year) if you suddenly introduce Social Media to your business mix and start seeing a change in non-financial impact and (hopefully) financial impact , then that’s a sign that something has changed. Something is working. And it doesn’t take a genius to infer that there is a good chance that the new addition to the mix is the likely culprit.

The next step is to start actually working your way back from impact to reaction to action. That’s when you start needing an SM monitoring tool. I’ll show you why next week. 😉

Olivier – I’ve enjoyed following this series as it’s basically my life for the firm I work for. I have to tell you, if we were all as good at describing this process IRL we’d have far fewer discrepancies about what ROI is or isn’t. I liked the way Don Bartholomew described this recently – engagement and influence. It sounds like you’d say that influence is the actual “I,” and that the engagement part isn’t necessarily part of the ROI process? It’s important, but something different. Am I reading that correctly?

Chuck, within the context of the ROI discussion, the “I” in ROI is “investment.” It isn’t influence, interest, or any other word starting with the letter “I”.

This isn’t to say that influence isn’t important, but it isn’t relevant to the ROI discussion as it pertains to what a business is asking for. “Influence” lives in the world of non-financial impact. It is a factor that can lead to financial impact (the “R” in ROI), but it is not an element of the revenue-specific ROI equation: (Money spent vs.money earned.)

Does that make sense?

That is helpful, thanks. I don’t think he was trying to make the “I” anything other than investment. It was just an attempt to break up the SM ROI bucket into engagement and influence, with many of the more transactional metrics falling under influence.

I see the point though.

One other question…you mentioned in your post and video that if your client/superior doesn’t ask about it that’s great. That they probably understand that there is an investment in relationships upfront.

Wouldn’t you say, though that it is our role as pros to bring it up, even if they don’t?

That’s a very good question.

What I can tell you from personal experience is that the ROI discussion always comes at some point. New CEO, new SVP of this and that will come along and ask for data. Maybe not today, maybe not tomorrow, but someday. If a program costs money, it requires a budget. And anyone responsible for a budget is accountable for results. You don’t want to find yourself in a position where three years from now, some newly appointed hotshot Vice-President starts asking ROI questions you can’t answer.

So I wouldn’t completely blow off ROI-type measurement just because the client doesn’t see a need for it yet. His/her absence of forethought shouldn’t become your cross to bear.

Besides, it’s nice to be able to present that data on a regular basis for two reasons:

1. Companies love to see results. Show them results they can understand and appreciate and they will buy into your program even more.

2. Results tell you what’s working and what isn’t. If you aren’t measuring and tracking non-financial and financial impact, you don’t really have a way of making adjustments as needed. You’re driving blind. That’s never good. 😉

If Influence was part of the equation it would look like this ROII – Return On Influence Investment, it would add to the confusion IMHO. Or maybe that is an equation to consider?

You’re right. It would be confusing and I doubt any business exec would ever ask for that. So don’t worry about trying to create an ROII thing.

Now, if you want to tie your investment to various aspects of influence and try to see if there is a correlation between that investment and some kind of impact, you can. That would be very interesting, but it is a completely different discussion. 😉

Keeping within the context of investment and business, may I suggest your blog title (and/or lead-in paragraph) should be amended to reiterate this point? Else, a member of the local church or school board looking to increase their institutions’ social media involvement may be thinking about cash and get flustered.

I hear ya. My title is already so crazy long, I don’t know if I can make it any longer. I’ll give it some thought and see if there’s a way to make that happen.

Though… this post is specific to the revenue-focused ROI conversation. It doesn’t go into cost-saving ROI or any of the other types of impact that a church or school board might be interested in using SM for. 😉

Chuck and Olivier,

To clarify, the social media measurement model I’ve put forth – Exposure—Engagement—Influence—Action really is an alternative taxonomy to Olivier’s Action—Reaction schema. We agree on what ROI is and isn’t.

Measuring Exposure/Engagement/Influence as well as Actions/transactions allows you to capture non-financial value/impacts as well as tangible ROI in those cases where revenue, cost savings or cost avoidance can be quantified and tied to the program. And it provides a framework to explore the relationship (e.g. correlation) between E/E/I and downstream metrics like sales.

Hope this clarifies and doesn’t confuse further.

-Don B @donbart

That does clarify, Don. Those two models overlap each other beautifully. I see yours as an excellent description of the process that happens in that middle section. I like it a lot.

Good post, Olivier.

I think you are right that we have to concentrate and actual sales when it comes to ROI justification. Social media monitoring and ‘listening’ to the conversations shows the full journey a customer will go through from awareness through to making a purchase, but the bean counters on the client side will be less interested in that. I think the ROI for that middle bit of the funnel taps into research and customer service budgets rather than advertising at the moment, but it should converge once you can demonstrate the whole journey.

One question – Radian 6, Cymfony are on the pricey side. Any suggestions on how smaller brands or agencies should monitor the social web other than by hand using the free tools? Viral Heart has recently launched and seems to be going for the long tail with their pricing but I am yet to see it in action.

Great points, Ed.

I’ll have to do some research on that. I have to confess that I am not on top of all of the smaller apps out there that you could bundle together to build a custom monitoring dashboard. Cost can definitely be an issue with smaller companies, I hear ya.

That said, there comes a point where you end up spending a lot more time (resources = money) trying to manage dozens of apps to replicate what a more robust tool like R6 does on its own than you would have if you just bit the bullet and spent the money upfront. So by trying to save money on the tool, you n end up spending more money on man hours. So be careful with that. 😉

Hey Ed – I recently had SM2 by Techrigy referred to me by an agency as an alternative to Radian6. Haven’t personally used it, but I have been very UNimpressed by Radian6’s sales force. Their cycle from lead to information has been incredibly slow. Check it out http://www.techrigy.com/

Good commentary on the importance of financial elements of a true roi.

One challenge I see frequently is for marketers who must give some ‘forecast’ of the financial return that an investment in marketing will deliver. Especially when it is a condition of funding.

The lack of clear cause and effect relationships between many marketing elements (e.g., communications) means that actual ROI will be measured only after the fact…which is obvious perhaps, but which also doesn’t do much to manage risk when selling risk-averse CFO’s and business managers on things like social media.

Any examples of successfully equating the ‘potential energy’ of nonfinanical measures in unleashing the ‘kinetic energy’ of real financial return?

thanks!

I would love to see a white paper that shows a relationship between that potential energy and the resulting kinetic energy, but I haven’t seen one yet.

Great point about

risk-adverserisk-averse managers wanting guarantees. I run into them regularly, and it’s amazing how vulnerable these guys are to anyone armed with a convincing illusion of guaranteed success.The truth about investment decisions is they are ALWAYS about the unknown. You don’t go into a fight or a race or a business investment KNOWING if it will actually work. There are no guarantees. So

risk-adverserisk-averse managers need to grow a pair and start doing what they’re paid to do: making difficult and sometimes risky decisions, but intelligent and truly informed decisions. They need to weigh the risks against the rewards and then figure out how to stack the odds in the favor of success. That’s what a business leader does.If they need guarantees of success before approving a budget, they’re living in a dream world and I have a bridge to sell them. 😉

Anyone who manages to sell a business on a “guarantee” of success is full of crap. Even if they turn out to be right in the end, that initial “predictive math” is little more than smoke and mirrors.

Hi Ed,

There are a ton of good tools out there. With the economy, in 2010 there will be half a ton. 🙂

Couple of quick points:

– Cymfony is much more expensive than Radian6 in my experience. The entry point for Radian6 is about $600/mo. Cymfony implementations can easily be $100,000 per year. The two companies also have very different approaches and business models

– A less expensive alternative to Radian6 is Scout Labs. Jason Falls (@JasonFalls http://www.socialmediaexplorer.com) did a great review of the two tools. You can see it here: http://www.socialmediaexplorer.com/2009/04/13/social-media-monitoring-grudge-match-radian6-vs-scout-labs/

I recommend you check Jason’s blog for great info on social media tools. -Don B @donbart

Olivier, this is so good it makes me crazy.

The traditional three-stage measurement strategy is Outputs, Outtakes (sometimes called different things) and Outcomes.

The Return in ROI is an outcome of various activities — the buying decision depends on awareness, understanding, commitment and action. Your activities have to match up with those factors. You can’t get a sale if no one knows your product, understand how it fits their needs, compares favorably to other, similar products and finally, either asks for the sale or presents the ability to buy.

PR measurement is moving along a continuum of growth, from measuring the transactional to the strategic. Much of PR (outside of product PR) focuses on the awareness and understanding aspects. That’s why we see Ad Value Equivalency still in use. But it’s the commitment and action phases that lead most directly to revenue — notwithstanding that we can’t get to commitment and action without awareness and understanding.

The math kicks our butts in these matters, because the PR activity isn’t taking place in isolation — there are many other factors influencing the buying decision. Marketing has quantified many of these elements, which is why marketing metrics seem to outpace PR metrics (despite the efforts of many people…)

Nonetheless, marketing mix modeling and other multivariate analysis are being applied to this issue, and there are examples of success (hello Angela Jeffrey, Katie Paine, Don Bartholomew, Mark Weiner, David Michaelson and others…).

Keep going…

Thanks, Sean. 🙂

The ROI discussion seems to continue “moving” people. Great to see how you motivate people to understand ROI. I’ve made similar remarks on previous posts.

I’ve been reading quite a lot on ROI lately to understand if there can be other factors than money at the end of the equation. I did find some interesting reads, you might be interested in:

The first one is titled: “Productivity in a Networked Era: Not Your Father’s ROI” and can be found here:

http://www.clomedia.com/features/2009/July/2672/index.php?pt=a&aid=2672&start=0&page=1

The second one is a comment by Graham Hill on the Paul Greenberg article on SCRM (link is at the end of the quote):

– start quote –

“the fact that we are

exclusively talking about a simple metric like ROI as a

measure of the value created by Social CRM, shows that we

are still stuck in Measurement 1.0 thinking.

One thing is for sure, companies do need a measure of the

value created by Social CRM. Whether that is a traditional

inside-out measure like ROI, or a more collaborative

measure like ROII, or even more fundamental measures

such as a combination of e.g. CFROI and CAP (Competitive Advantage Period), will no doubt be discussed in the coming months. But these measures are largely only about the ex post returns that companies receive from their incremental investments.

Social CRM revolves around the co-creation of value with

customers. It is about service-dominant logic rather than

goods-dominant logic. That means we need to understand

the value that customers earn from co-creation as much as

the value that companies return. Customer perceived value

is thus just as important as ROI. If you don’t understand

the trade-offs between Customer Perceived Value and

company ROI, you are in danger of focussing on only half

of the value creation equation to the detriment of total

value creation.

It is time to create a set of measures of value creation that

represent the larger co-created Social CRM picture. That

includes Customer Perceived Value. ROI and other one-

sided measures are not enough in a Social CRM world. It is

time for Measurement 2.0.”

– end quote –

Link to quote:

http://talkback.zdnet.com/5208-17933-0.html?forumID=1&threadID=66383&messageID=1253451

My take: there is still a lot of ground to cover before we find out how to measure the true “value” of Social Media. I’m convinced now it cannot be a one-sided-inside-out-single-metric like ROI.

It must be a combination of metrics that values both sides of value creation.

Until “we” have figured that out and until that’s common “understanding” you are absolutely right: ROI, defined in $$$ is the only way to get it sold to executive management.

Please share your thoughts.

Wim Rampen (@wimrampen on Twitter)

Right. Great point, Will.

Look, I want to be super clear about the fact that I don’t equate ROI with the whole value of Social Media to an organization. (I’ve posted about this before.) ROI is one very small part of the value but it’s the one that social media pundits consistently get wrong. All I am trying to accomplish with these posts is bring some clarity to the ROI question specifically. 😉

I want to make sure you don’t mistake my focus on ROI for a belief that ROI is the end-all, be-all of Social Media’s value. That would be incorrect.

That said, when it comes to end-game business objectives, it all eventually comes back to the P&L. There’s just no escaping it. So 1. ROI is bound to be part of the discussion, and 2. if we’re going to talk about ROI, we might as well understand what we’re talking about and where it fits in the grand scheme of things.

😉

Hmmmm

I’ve watched the video twice and read throught the post twice and I’m still really, really trying to see where the ‘How’ starts.

I can definitely see more clearly the steps in the process that are important, yet not ‘measurable’ as far as ROI is concerned.

I hope that was the ‘Amuse Bouche’ of the 6 course feast we’re about to dive into because you have definitely made me hungry.

Cheers

Fundamentals first, Michael. I would be doing everyone an injustice if I jumped right in without laying the foundations first. 😉

Good point.

Thanks again for doing all the heavy lifting on this one.

I’m excited and hopeful, not frustrated, at the prospect of learning something that’s become so needed in this industry.

I just need to enjoy the ‘course’ that I’m on instead of salivating over the next one. (That’s the last meal analogy I’ll make – promise!)

Cheers

I hear ya. There’s another reason for my slow pace when it comes to releasing this: I have noticed that some “measurement experts” like to swoop in after I’ve explained certain concepts and claim to have been executing on them for years – when they clearly haven’t. To add insult to injury, they then present my methodologies as their own at conferences. I don’t like that very much. Actually, I don’t like that at all.

By releasing this info one little nugget at a time, I can keep them at bay for weeks if not months. When they finally repeat their plagiarist shenanigans, the timing of their sudden “jumping on the bandwagon” will be a lot more obvious.

I’m all for people using and tweaking the advice I share on this blog (that’s the whole point), but when some try to pass off my insights as their own, they step over an ethical line I don’t take lightly. More on the ROI discussion next week. 😉

You know, I’ll be honest I’m always amazed that ROI brings up so many discussions. In my undergrad business courses it was hammered in that ROI is a financial metric. Not to sound harsh but maybe a pre-req for any social media “consultant” is a business degree!? That would solve some problems in my opinion.

The ROI discussion is starting to feel like a philosophical one…where’s good ‘ol Plato when you need him?

Awesome comment, Jacob. I feel the same way. I’m not a measurement guy – not by a longshot – but I understand ROI because I have managed businesses and worked in the corporate world where these discussions happen daily. I can’t really wrap my mind around why it seems so hard for “experts” and professionals with years (sometimes decades) of experience to understand something that a first year MBA candidate would be taught in their first three weeks.

I think it may have something to do with the fact that most Social Media “practitioners/consultants/experts/gurus/whatever” come from agency or marketing firm backgrounds and have never worked outside of the Marketing bubble. Their world of metrics is COMPLETELY different from real world business metrics. They live in a world of exposure and media measurement. They are detached from business objectives and business performance. They get paid to to touch the public and that’s basically it.

So it isn’t really their fault. Their experience with metrics has just been completely detached from what their clients are now asking for.

Great comment, man.

Olivier, I know you’re been pondering How to do the “How”… what about some examples, either made up from your experience in the field or submitted by your readers so that you have something to explain in detail more easily than non-specific examples? Just a thought I wanted to toss out there. I believe 100% in the social media R.O.I message you’re sharing and just cringe when I see the newly made up terms like return on influence, return on intentions, return on mentions, and on and on and on.

I am ESPECIALLY concerned about the term “Return on Influence” that is being promoted by some PR, marketing and social media consultants in lieu of what I call (because of you) “real R.O.I.” I am now seeing the term used because of its connotation to the actual financial definition, in attempt to sell ads on social media networks and promote a pyramid scheme, and that is totally lame. This crazy term is being used more and more lately.

I believe measuring other metrics is necessary and can help you refine what you’re doing, but it’s not a replacement for an R.O.I. plan. I like this point: “Social Media is fun, but this is not a game. If a client doesn’t ask about ROI, great! Awesome. They probably get how Social Media is going to help them build relationships with customers and improve everything about their business. So to them, ROI is implied.”

All I want is for people to keep things categorized where they belong and not try to call a Duck a Show Poodle, in order to sell our services to perplexed customers seeking answers. This shouldn’t even be a debate, because the business terms are in place. Why folks think social media marketing demands newly made up terms to justify it as a marketing tool is something I cannot understand.

“All I want is for people to keep things categorized where they belong and not try to call a Duck a Show Poodle, in order to sell our services to perplexed customers seeking answers. This shouldn’t even be a debate, because the business terms are in place. Why folks think social media marketing demands newly made up terms to justify it as a marketing tool is something I cannot understand.”

Pow. Framing that right there.

See my exchange with Jacob (above).

I think there is a VERY big difference between a social media consultant that actually understands the tools and can show you how to integrate into your business (i.e. understands how a business works, can help with measurement, etc.)

AND

someone who just know how to use the tools. In my opinion someone that knows how to use the tools isn’t necessarily a consultant at all, they are just some guy that knows how to use the tools.

I know how to use a laptop but I’m not touting myself as a “computer or laptop consultant.” I can use a shovel and can lay down bricks, but I’m not a construction worker.

I think starting now I’m not going to take anyone seriously in the social media world unless they have some sort of business background. We’re reaching a level of absurdity here.

Jacob

IMHO – the best brick layers in the world don’t own construction businesses. The smartest laptop guys don’t own computer businesses.

I think it’s a rare bird that knows how to effectively use the tools of Social Media AND understands businesses to a degree about which you are speaking.

Do you really want a bunch of MBA people running your Social Media program?

Maybe there’s a 2-part harmony somewhere here.

Cheers

I definitely don’t want MBAs running social media programs (save the rare exception). 😀 But I am not against MBAs sitting down with Social Media folks to help them put together business-relevant measurement methodologies. 😉

Agreed. 🙂

Great post,

Love the ideas in your post. This is the part that is so hard for big law firms to understand, the end result of social media has to be an increased bottom line and decreased marketing costs.

Unfortunately, many of these old firms aren’t used to tracking ROI because it was such a challenge with traditional advertising. Social media provides the luxury of tracking every single click, where it came from, and who or what message inspired the click.

Awesome video as well!

@adriandayton

Thanks, Adrian. You’re right: Three years ago, the tools weren’t there. 🙂

@Oliver – Wowsers what a great discussion on ROI. But hey I’m not surprised as you certainly are one of the guys leading the charge in social media on the topic. Thanks for all of the Radian6 shoutouts.

@gavin – Sorry for letting you down on the response time. Really glad we had a chance to have a great chat this morning and definitely looking forward to having your feedback on the Radian6 platform.

@ed – thanks for the feedback on Radian6. I’m around anytime if you want to dig in because I totally agree that “Social media monitoring and ‘listening’ to the conversations shows the full journey a customer will go through from awareness through to making a purchase”.

Cheers.

@davidalston

Radian6

@david – thanks for the call today. Very impressed with the speed of contact. Looking forward to chatting more

Thanks for the kind words. You’re very welcome. R6 deserves the praise. 🙂

Jacob and Olivier, bang on with your comments re business savvy folk intrinsically having a better understanding of ROI than those that haven’t had the same exposure. I spent much of my marketing career client side where monthly meetings with the management team hammered in the importance of ROI in every marketing, PR and (now) social media activity. I don’t claim to be a marketing expert, a pr expert, a social media expert, or indeed a measurement expert, what I am is a consultant that applies the right tools (which could be any of those) to help my clients achieve their business objectives (and a large percentage of these are about increasing revenue – which is really what we’re talking about here).

A huge part of what I do has always been the ‘measurement’ bit and I’ve been quietly building the SM side of this over the last 6 months or so. Olivier, your advice has been a great help with this, which I thank you for (again). I cross paths regularly with consultants that have only worked agency side and I too can’t understand how they just can’t seem to grasp ROI in the way that Olivier explains it. It really must come down to a lack of exposure to the ‘business’ side of things.

One area of ROI I wanted to touch on is this. If we’re not measuring the R bit (£££s in my case guys) we (as agents, consultants, inhouse SM/marketing people) also fail to highlight any conversion issues the business may have. If SM, as a marketing tool, is generating leads but then these leads are not converted by the sales team (or whatever process they have to go through) then how can they learn about this without an effective ROI system? It could be easy to point the finger at the SM (or other marketing) activity for not producing the leads in the first place and a pretty important kink in the system would go unnoticed. For me this is all about integrating each step of the process (and Olivier’s schematic explains this well), understanding how each bit is working towards the desired outcome (the £££s) and monitoring this so that anything that isn’t working can be tweaked (or stopped) before too many £££s are lost.

Awesome comment! Thank you. 🙂

Agree with a lot of your points, however, some of it states the obvious and still doesn’t give readers the means of measurement or the metrics to use or a specific model they can embrace i.e. converting sentiment or conversation or other sm numbers to conversion or purchase of loyalty.

It’s obvious to anyone in the space that eyeballs + engagement+ conversation does not equal revenue necessarily.

However, there is also the possibility that over the long term the value of increased, deepened relationships with customers does generate ROI. But where is the model? What metrics matter? How does a company determine? Is it all long term, or are there short term measurements that allow us to see the impact of our efforts.

I think that every brand in the space (including the big players like Zappos, which is now realizing that SM can’t deliver the new customers it needs and so is in search of an advertising agency) is trying to figure it out.

We have lots of ways to measure conversation, sentiment, RTs, links, engagement, etc, but are still trying to develop a standard model (we end up customizing them for each client) that is reliable.

It’s often easy to refer to old metrics (reach, impressions, etc.) but they don’t do the job either. It’s not about measuring the success of offers to Facebook fans, but rather determining if the recent college graduate who flew Virgin America and tweeted about her trip ends up becoming a loyal customer due to Virgin’s tweet back to other passengers asking that someone buy her a congratulatory drink. How do you measure that? An interesting challenge.

Will look forward to your next posts and thoughts.

Ed, the method is coming. I have to lay out the fundamentals first. (And in digestible bites at that.)

I don’t want t disagree with you, but it isn’t obvious to everyone in the space that media measurement doesn’t equal ROI. As a matter of fact, many “experts” (and I use the term as loosely as I can) tout SM ROI measurement methodologies that only focus on eyeballs, clickthroughs and conversations. Being that they are “the experts,” many people (and companies) end up following them down that dead-end path and pay handsomely for their trouble. I used to take it for granted that people understood something as simple as ROI but I now realize I was wrong. Many don’t. So here we are. Starting from scratch and taking the time to explain this process as clearly and thoroughly as possible so I won’t have to do it again. 😉

Also, I would caution that there probably isn’t a standard (read “cookie-cutter”) model that will work (yet). Every company is different. Every company has different goals, different customers, different cultures, different budgets and tools and channels. So in order for the model to work, it has to be highly adaptable. And the analysis is still time-intensive and manual (or should I say cerebral). So rather than a nice, clean equation type model, think about the methodology first as being a measurement philosophy that blends SM monitoring and actual business performance.

Don’t worry though, we’ll get there. 😉

Thanks for this Olivier! This helped a ton to build the foundation, so I’m really looking forward to your next video. This post and video really help to dispel the myth that ROI is a simple 1-step action measurement

What’s lacking for me in the ROI calculation is seeing this concept applied to actual examples – in my research, no one seems to be sharing how they’ve calculated their ROI and what that process included. It’s all a little high-level and cerebral to me at this point.

Appreciate all your help and insights!

If anyone ever tells you that the ROI of Social Media can be distilled in a simple equation without requiring a lot of analysis and ground work beforehand, run. Five years from now, the tools will hopefully be sophisticated enough that we will be able to automate the process a little more, but right now, it takes work. It isn’t quite game theory level analysis, but it does take a sharp, savvy mind and a good deal of focus. 😉

What I hope to accomplish here is to make the process philosophy simple enough for everyone to understand.

Oliver, this was very interesting, but I have issues with your comment about not including subjective numbers into the ROI calculation (or I am not getting everything you said, which is very possible). If you only count actual direct dollars into a specific ROI calculation, are you not short -changing the value of that specific activity? What about the life time value of a customer? (which would be a subjective number based on historical trends) If you only count the current purchase, then I would think there would be a significant portion of a product’s revenue that gets attributed to nowhere? In our business, and I think this would not be uncommon, 80% of our revenue comes from previous customers (last year’s purchases coming back) and 20% is new business – so where are you attributing that 80%? Lifetime value is just one issue, what about customer referrals, again, a revenue number that would need to be subjective based on historical trends. From my understanding of what you are saying, if you only count direct, immediate attributable dollars, there will be a lot of areas of revenue that do not get counted as ROI towards any marketing activity, and so how can you make intelligent decisions on the ROI of a single activity in a vacuum? Then what is an acceptable ROI if you do not count the indirect revenue that will never ever materialize without that activity? By the same token, if you cancel an activity because the current direct ROI is negative, how will you account for all the subsequent revenue that you have now lost as well? One single activity can have so many affects in various parts of an organization that can be virtually impossible to measure, but because you cannot measure any given activity completely by itself in a vacuum does not mean the value is not there. I believe your comment on measuring the delta of activities is what is required – we increased spending on these x activities by y, and our overall revenue for that product increased by z – is that increase acceptable? good, then call it a day. You need to measure what you can measure and then have to make assumptions about the rest, because you cannot measure everything. Trying to measure everything wastes resources and leads to poor decision making, because it is impossible to measure the cause and effect of every possible interaction and relationship an activity has.

Brent, I understand what you are asking, and you’re right about your points on different values. I will get more into this in upcoming posts, so no worries. I think we’re on the same page.

Let me try to answer one of your more important questions, and then I will explain why the focus of these pieces seems so… narrow:

1. In terms of ROI, the lifetime value of a customer is tied back to how they influence financial impact (either directly or indirectly) today, tomorrow, a month from now, and so on. And since ROI is measured over time, we aren’t talking about simply measuring single campaigns or events but how these unique events fit within a much broader and longer term engagement. The method I will soon explain in more detail takes into account the breadth of elements you suggested in your question/comment. (Things like referrals, influence, frequency of interaction, positive vs. negative mention, etc.) There’s a whole “back end” to this that lives in the non-financial impact portion of the schema that is absolutely vital to understanding what works and what doesn’t. It will also help predict where things are going over time, which is nice. (Kind of like financial indicators for macro-economists.) I just can’t get into that yet. I don’t want to confuse the issue at hand: Defining ROI.

2. I understand your concern about measuring in a vacuum. That is not something I suggest doing. Quite the contrary: The measurement method I suggest distills steps leading to financial outcomes from a breadth of data that takes into account channels, influence, activities, media, etc.. The process doesn’t stop there. Measuring the impact of SM, Marketing, PR and other activities using this methodology does much more than measure/calculate ROI. But the reason I am focusing so much on ROI in such specific terms here is because there is an immediate need for people in this “discipline” to understand what ROI is and isn’t. It isn’t eyeballs. It isn’t influence. It isn’t that middle part I describe in my diagrams. Before we can start looking at the entire breadth of (positive) impact that SM can bring to a company, we need to nail down this very specific point or we’ll still be arguing about ROI really being “Return on Influence” or being measured with Google Analytics a year from now. That nonsense needs to stop before we can go on. 😉

I’m glad you took the time to write your comment.

Hi Oliver,

I just got to this posting in my Google Reader. Good stuff. My question to you is what is the appropriate answer to give a CEO/Client who is asking what the ROI of a marketing campaign is? Do you want to try to infer what the value could be through historical analysis (I think you’d want to include any expected and unexpected volatility in that analysis)? Or do you just simply say, “We don’t know what the impact will be until we measure transaction growth X months from now.”

Both of those approaches don’t seem quite right in getting the investment for a campaign. What would recommend is the right way to approach answering that question?

You can set goals. I’ve worked in environments that required a 10 : 1 (return : investment) ratio for every project. The trick was to try and reach that goal. (Lit a fire under our butts.) I think that you always want to start with the outcome you want. That’s the starting point. Always. First, determine where you want to go, what you want to accomplish, and then work your way backwards to what it’s going to take to get there.

There’s no simple answer to your question. My advice is to have a frank conversation with management and discuss the outcome they are looking for in real terms. In specific terms as well. They want more sales? Okay. How? Do they want those extra sales dollars to come from net new customers, from existing customers buying more often? From existing customers buying more? Each one of these requires a different approach, different tactics, different tools and very different budgets. It isn’t as simple as saying “just sell 10% more stuff.” The leadership has to understand what they want so you can distill it to a specific action plan.

Once you get the discussion to that kind of level, when it becomes that strategic, then the ROI discussion becomes much richer. Less of a basic $$$ in, $$$ out equation in which numbers overshadow the real conversation: What’s it going to take to get XYZ done?

Truth is, measuring success isn’t “doing”. I can measure success and failure all day long, but unless the company is committed to seeing very specific results and figuring out how to get it done, it’s all for nothing. It can’t just be about throwing $x amount of money at a program and expecting a return just because someone had a nice “plan” or presentation. You have to get to the what, why and how before you can start talking about how much. 😉

I read most of the threads in this discussion on SM and ROI. There are some very good points made and some great questions posed as well.

I see a few things happening in my dialogue with clients and agency partners- people are looking at SM as many tactical tools to engage customers from a marketing POV.

Those metrics must support core marketing initiatives which are assumed to be correct. Some use SM as a disruptive practice and by design are experimental so that ROI is subjective.

The inclusion of Social CRM opens up the obvious discussion about “SALES”- whether as a call center, account teams, channel partners etc.

If an organization is using CRM as pipeline management only, I doubt they are effectively driving sales with CRM- it’s a database tool set. True integration of Social CRM allows all sales touch points to integrate with a strategy which also benefits from key marketing intitiatives.

When you have the full 360 degree model synchronized across these functions, you can measure both marketing metrics and sales metrics – predictable revenue capture.

So everyone is right in terms of definitions of ROI, but each needs to understand what “The bosses boss” is measuring and why.

Like any new business practice lead by technological innovation (MRP, CRM etc.) Social Media Marketing tools cannot lead the strategy. The web guy or graphics designers are not qualified to present an ROI case to executives- MBA’s do not necessarily get Social Media Strategy etc. so it’s a steep learning curve for all stake holders.

Exciting discussion- I welcome any feedback and look forward to more on this topic.

Craig

Long but good explanation of ROI. But obviously Social Media is an expense in 9/10 cases not a business model or invest with expected returns.

If that is the case, it is because those organizations have not yet figured out how to look at Social Media in any other way than a negative on their P&L.

Why on earth wouldn’t SM be an investment with any expected returns? Virtually everything in business, down to buying pencils, is a cost associated with it that’s expected to bring a return of some type, no?

This is just great. Amazing presentation…. Wish he was at Blog World Expo…the ROI presentation could have used some of these hard examples instead of just talking in circles…. thanks

Thank you. You can find a lot more stuff like this at http://www.smroi.net

I wasn’t invited to speak at BlogWorld. I was, however, invited to speak at the #LikeMinds conference in the UK on the same dates, where I presented on ROI methodology. It isn’t for me to say whether some conferences focus on hype while others focus on solid content and real issues and methodologies, but one could definitely make the argument. 😉

Cheers.

Well nice info.but some piratical e.g can be given so its would be more useful

We are creating a social media metrics application at http://www.twentyfeet.com that will centralize all your web stats in one place. We only have twitter, facebook and bit.ly so far.

I would love to get your feedback about it, as soon as it gets live in the next weeks. Your blog post is in the middle of our activity and would be so valuable, to get your insights for our development.

Yes, I admit it, even I have used “ROI” as a relative term on a number of occasions in the past.

We all have. No worries.

Our Financial Lead Generation System delivers warm leads to your inbox. Lead generation starts with an online marketing plan and a commitment to. our Site.

Social Media is playing important role for Brand Marketing. Every Business owner should use social media to engage with people.